Solve the Self-Employed Retirement Dilemma

The challenges of self-employment seem endless. You are your own chief marketing officer, chief financial officer, chief executive and junior assistant. With all of the roles you play, it’s no wonder that you haven’t spent much time planning for retirement.

The good news is that the right retirement plan can address more than just your retirement—it can help lower your taxes and reduce the need to rely on a welfare system in your retirement years. And you don’t have to search alone for that plan: Your financial advisor can help you weigh your plan options and build an appropriate investment strategy once you choose a plan. And your accountant can calculate the potential tax savings this new retirement plan will generate.

So which plan is right for you? The first option you should consider is an IRA or a Roth IRA. Both offer tax advantaged growth, but in different ways: The IRA grows tax deferred, meaning your contributions are tax deductible but you won’t owe taxes on your savings until you start making withdrawals. Contributions to a Roth IRA are made after taxes, but you won’t owe any taxes when you take withdrawals.

Anyone can contribute to an IRA, but not everyone is allowed to make tax deductible contributions. For instance, if you already have a retirement plan in place, your contributions likely won’t be deductible. But if you have a retirement plan, you may still be able to contribute to a Roth IRA, which bases eligibility on income levels. (In 2018, the Roth IRA income eligibility limits phase out between $120,000 and $135,000 for single filers and eligibility limits phase out between $189,000 and $199,000 for married couples filing jointly.) For 2018, individuals can make annual contributions of up to $5,500 to both IRAs and Roth IRAs. If you’re over 50, your limit rises to $6,500 a year thanks to an extra $1,000 in catch-up contributions allowed for older individuals.

If you want to save more than an IRA or Roth IRA allows, consider a formal retirement plan such as a Simple IRA, SEP IRA or an Individual 401(k).

The Simple IRA is easy to establish. You can contribute a maximum of $12,500 annually if you are under 50 and $15,500 if you are over 50. In addition, you can contribute 3% of any W-2 wages. One note: The deadline to establish a Simple IRA is October 31, so don’t wait until the end of the year to open an account.

The next option is a SEP IRA. The annual limit for a SEP IRA is $55,000 or 25% of self-employment income if you are paying yourself a salary. The deadline to establish the SEP IRA is your tax filing deadline plus extensions. Therefore, you can put off starting a SEP IRA until well into 2019. For that reason we call it “the procrastinator’s retirement plan.”

The third option is the Individual 401(k). The annual contribution limit for this 401(k) is $55,000 if you are under 50 and $61,000 if you are over 50. The 401(k) can either be a traditional 401(k) (contributions are pre-tax, but withdrawals are taxed) or a Roth 401(k) (contributions are after tax money, but withdrawals are tax free).

There are no income limits for the Roth 401(k). The deferral is made up of two parts. The first part is the employee portion, which has a limit of $18,500 if you are under 50 and $24,500 if you are over 50. This deferral can either go into the 401(k), the Roth 401(k) or a combination of both. The remainder is the employer contribution, which has a limit of 25% of compensation.

The deadline to establish this plan is December 31 of this year. The employer contributions can be contributed later but employee deferrals need to be in as soon as they are withheld from your paycheck. Therefore, you can’t wait like the SEP.

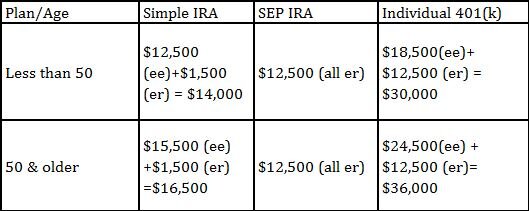

How do these plans stack up? Let’s look at an example. Say you are self-employed and you pay yourself $50,000 in W-2 salary. Here are the limits for each plan.

*ee= Employee contribution, er= Employer contribution

What’s the verdict? The 401(k) is the big winner. The Simple IRA is a good option for those with lower incomes, while the SEP is good for those who tend to procrastinate.

If these contribution limits are not enough, then you might want to consider a Defined Benefit Plan, which can be paired with a 401(k). Contribution limits to Defined Benefit plans are based on actuarial calculations, but you could be able to contribute $200,000 or more each year.

As always, it is important to coordinate with your financial professional to see what plan is best for you. Please contact me if you’d like to explore your retirement savings options.

Robert J. Pyle, CFP®, CFA is president of Diversified Asset Management, Inc. (DAMI). DAMI is licensed as an investment adviser with the State of Colorado Division of Securities, and its investment advisory representatives are licensed by the State of Colorado. DAMI will only transact business in other states to the extent DAMI has made the requisite notice filings or obtained the necessary licensing in such state. No follow up or individualized responses to persons in other jurisdictions that involve either rendering or attempting to render personalized investment advice for compensation will be made absent compliance with applicable legal requirements, or an applicable exemption or exclusion. It does not constitute investment or tax advice. To contact Robert, call 303-440-2906 or e-mail info@diversifiedassetmanagement.com.

The views, opinion, information and content provided here are solely those of the respective authors, and may not represent the views or opinions of Diversified Asset Management, Inc. The selection of any posts or articles should not be regarded as an explicit or implicit endorsement or recommendation of any such posts or articles, or services provided or referenced and statements made by the authors of such posts or articles. Diversified Asset Management, Inc. cannot guarantee the accuracy or currency of any such third party information or content, and does not undertake to verify or update such information or content. Any such information or other content should not be construed as investment, legal, accounting or tax advice.