Understanding Value Investing

Investors continue to grapple with the concept of “value” in value investing. But for those willing to bear this risk, value stocks have ultimately provided the reward of higher returns. Here’s how to unlock the potential of value stocks.

Key Takeaways:

A value stock generally has a low price relative to various measures of a company’s worth, including the company’s book value, sales, earnings and cash flow.

Value stocks can be seen as being riskier than growth stocks in regard to both their company-level characteristics and their exposure to economic cycles.

For those willing to bear this risk, value stocks have ultimately provided the reward of higher returns.

Keys to unlocking the potential of value stocks. A quant perspective.

Investors continue to grapple with the concept of “value” in value investing. No single unique definition of value exists. Generally speaking, a value stock has a low price relative to various measures of a company’s worth, including the company’s book value, sales, earnings and cash flow. These company attributes tend to correlate with other measures that intuitively seem risky to investors, such as the company’s financial and operating leverage, its profit margins and variability of its financial results. Thus, looking across the cross section of companies one can invest in, value stocks are often seen to reflect concerns about a company’s profitability, stability and survivability. The different value metrics all reflect these concerns to varying degrees.

Real-world example

Consider for example two well-known stocks, Alphabet (Google) and Bank of America. The first is a growth company, with a price-to-book ratio of about 4.1 placing it so that the vast majority of stocks are cheaper. Alphabet has low debt, earnings have been growing nicely for years and there is a consensus that it is a very successful company. B of A is a value company whose price-to-book ratio of about 1.1 makes it cheaper than the vast majority of publicly traded U.S. stocks. It has a large amount of debt, and while its earnings grew nicely through 2007, they have vacillated since. B of A is widely viewed as having made several missteps during the financial crisis of the past several years.

This example illustrates the basic concepts of the risk argument. Certainly Google might be riskier by some metrics; for example, as a newer company some would consider them a greater risk. Nor will B of A necessarily outperform Google going forward. The latter has been a growth stock since inception and has continued to have strong returns. But generally the relationship between risk characteristics and value measures holds across stocks, and generally value stocks have outperformed their growth stock counterparts.

Impact of economic cycle

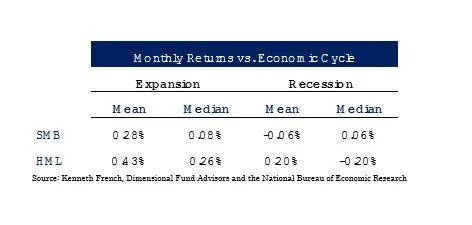

This value risk also manifests itself over time through exposure to the economic cycle. When times get tough, companies that have greater leverage or lower profitability will tend to suffer the most. The same holds true for smaller stocks. This can be demonstrated by considering returns of the value and size risk premiums during recessions and expansions. Returns for these premiums have been quite strong during expansions, but those returns fall dramatically during recessions. Recessions have been far fewer than expansions, and so these risks have historically paid off over time. And the risks from economic cycles are hard for investors to avoid.

Timing one’s entry and exit from the equity market can be very difficult. Recessions are often labeled as such well after the fact. Bear in mind the joke that “economists have predicted 10 out of the last 5 recessions.” And some of the highest returns to these premiums come right as or after a recession ends, so those trying to time their entry risk missing out on the strongest returns of the recovery. But for some of those willing to bear the risks, the rewards ultimately have followed.

The plot shows rolling 12-month returns to the Fama-French size factor (Small minus Big Company Returns - SMB) and value factor (High Value minus Low Value Companies - HML).

When these lines are above zero, small-size company returns beat large-company returns and value-company returns beat growth-company returns. These are superimposed over recessions, shown in gray. Data is from Kenneth French’s and National Bureau of Economic Research’s websites.

One can see that during recessions, value and smaller stocks truly show their risk characteristics and tend to lag their growth and larger counterparts. This adverse exposure to the economic cycle is another display of value’s risk characteristics.

Conversely, during economic good times value and small stocks recover and out-perform quite nicely. The chart below provides historical averages that offer numerical confirmation of the patterns seen in the plot.

Conclusion

Value investing continues to be popular, in part because it has worked well historically. There are a number of good explanations for this. We have focused on the risk explanation and have provided evidence that we find compelling. Value stocks are certainly not a sure thing, and they can disappoint at the worst times economically. But because of this risk, value stocks also can be viewed as ultimately providing the reward of higher returns for those willing to bear that risk.

Robert J. Pyle, CFP®, CFA is president of Diversified Asset Management, Inc. (DAMI). DAMI is licensed as an investment adviser with the State of Colorado Division of Securities, and its investment advisory representatives are licensed by the State of Colorado. DAMI will only transact business in other states to the extent DAMI has made the requisite notice filings or obtained the necessary licensing in such state. No follow up or individualized responses to persons in other jurisdictions that involve either rendering or attempting to render personalized investment advice for compensation will be made absent compliance with applicable legal requirements, or an applicable exemption or exclusion. It does not constitute investment or tax advice. To contact Robert, call 303-440-2906 or e-mail info@diversifiedassetmanagement.com.

The views, opinion, information and content provided here are solely those of the respective authors, and may not represent the views or opinions of Diversified Asset Management, Inc. The selection of any posts or articles should not be regarded as an explicit or implicit endorsement or recommendation of any such posts or articles, or services provided or referenced and statements made by the authors of such posts or articles. Diversified Asset Management, Inc. cannot guarantee the accuracy or currency of any such third party information or content, and does not undertake to verify or update such information or content. Any such information or other content should not be construed as investment, legal, accounting or tax advice.