New Retirement Plan Contribution Limits for 2019

By Robert J. Pyle, CFP®, CFA

Key Takeaways

Good news for workers: The 401(k) contribution ceiling has been raised $19,000 in 2019 ($25,000 if over age 50).

IRA and Roth holders can now contribute up to $6,000 per year ($7,000 if over age 50).

The contribution caps have been raised even higher for the self-employed.

See handy charts below for paycheck-by-paycheck breakdown.

While talk of Social Security’s demise may be exaggerated, there’s a very real possibility that many Americans won’t receive the full amount of benefits they’re expecting in retirement. Further, you don’t know how long you will live or what your true living costs will be in retirement—especially when unpredictable medical/eldercare costs are factored in.

Bottom line: It makes sense to save as much as you possibly can in tax-deferred retirement plans regardless of whether you are a salaried employee or a business owner. The rules are on your side.

Good news on the 401(k) front

The contribution limit for 401(k)s increases to $19,000 in 2019, up from $18,500 in 2018. Workers over age 50 in 2019 can make an additional $6,000 per year in catchup contributions, meaning you can now contribute up to $25,000 per year in tax-deferred retirement accounts. To put that sum into more realistic terms, many find it helpful to see what they can contribute on a paycheck by paycheck basis. Here’s a handy chart, based on monthly, semi-monthly or every- two-week paycheck cycles:

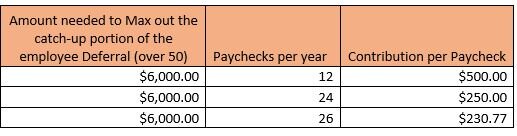

If you are over age 50, here’s how the additional $6,000 catchup contribution looks broken down by paycheck frequency:

IRA contribution ceiling also raised

There’s good news on the Individual Retirement Account (IRA) front as well. The IRA and Roth IRA limits have both increased by $500 in 2019. If you have an IRA, you can now contribute up to $6,000 per year, or $7,000 per year if you are over age 50. The same contribution limits of $6,000/$7,000 apply for a Roth IRA. Remember if you are over age 70-1/2, you can still contribute to a Roth IRA if you have generated earned income and if your adjusted gross income is below the eligibility threshold. You have until April 15th, 2019 to contribute for 2018 and until April 15th, 2020 to contribute for 2019. If you contribute early in the year, you will have your money working for you for a longer period of time.

Business owners can contribute more as well

If you are self-employed, the SEP IRA and solo 401(k) limits have been raised to $56,000 for 2019. In addition, if you are over 50 and have a solo 401(k), you can make an additional $6,000 in catch-up contributions for a total of $61,000. Just remember: if you want to set up an individual 401(k), you must do so by December 31st, 2018.

Conclusion

In today’s instant gratification world, it can be hard to set aside funds for the future. But, whether you are young or old, salaried employee or solopreneur, the tax advantages and compounding power of 401(k), IRAs and SEPs are just too attractive to ignore. You may not get same day shipping or bonus miles with tax-deferred retirement savings plans, but having peace of mind throughout your golden years is something you just can’t put a price tag on.

Robert J. Pyle, CFP®, CFA is president of Diversified Asset Management, Inc. (DAMI). DAMI is licensed as an investment adviser with the State of Colorado Division of Securities, and its investment advisory representatives are licensed by the State of Colorado. DAMI will only transact business in other states to the extent DAMI has made the requisite notice filings or obtained the necessary licensing in such state. No follow up or individualized responses to persons in other jurisdictions that involve either rendering or attempting to render personalized investment advice for compensation will be made absent compliance with applicable legal requirements, or an applicable exemption or exclusion. It does not constitute investment or tax advice. To contact Robert, call 303-440-2906 or e-mail info@diversifiedassetmanagement.com.

The views, opinion, information and content provided here are solely those of the respective authors, and may not represent the views or opinions of Diversified Asset Management, Inc. The selection of any posts or articles should not be regarded as an explicit or implicit endorsement or recommendation of any such posts or articles, or services provided or referenced and statements made by the authors of such posts or articles. Diversified Asset Management, Inc. cannot guarantee the accuracy or currency of any such third party information or content, and does not undertake to verify or update such information or content. Any such information or other content should not be construed as investment, legal, accounting or tax advice.