Get a Home Equity Line of Credit Before You Really Need It

Get a Home Equity Line of Credit Before You Really Need It

It’s especially important to establish your line before you retire

By Robert J. Pyle, CFP®, CFA, AEP®

Key Takeaways

When used intelligently, home equity lines of credit (HELOCs) can be excellent cash flow management tools.

Contrary to what you might have heard, the interest on HELOCs remains tax deductible when used to pay for home improvements.

Don’t wait until you’ve left the workforce to establish a HELOC. Even high net worth individuals can have trouble qualifying when they no longer show employment income.

We’ve been trained most of our lives to treat debt as evil and interest rates as the devil’s work. But, sometimes well-managed debt can provide substantial flexibility and leverage as you pursue your financial and life goals. Demonstrating that you can handle debt responsibly can also boost your credit rating.

If you are a homeowner in good standing, a HELOC can be a very powerful tool for consolidating credit card debt, paying for home renovations, a wedding, a new car purchase, unexpected medical expenses, auto or home repair, even college tuition. Despite the Fed’s recent hikes in interest rates, the rate you are likely to pay on a HELOC will be far lower than what you’ll pay on credit cards, auto loans, student loans, etc.

The key is to finance your big-ticket expenses without depleting your rainy day funds or cashing out stocks or other assets and incurring capital gains taxes—and possibly pushing yourself into a higher tax bracket, especially if you’re retired. HELOCs check all the boxes.

Many folks hope to have all their debt paid off before retirement. But a HELOC can be a very effective tool for managing your cash flow and account withdrawals in retirement.

Just make sure you obtain a HELOC before retiring

Many retirees are shocked to learn they don’t have enough monthly income to meet their bank’s debt ratio (debt/income requirements) when applying for a HELOC or home equity loan. Also, underwriting criteria for these so-called second mortgages has tightened up considerably since the last recession. Most lenders don't look at your assets; they only look at income and credit scores. In addition to retirement benefits (e.g., social security), you may have to provide proof of other income -- enough to make the loan payments.

Don’t believe me? We once had a self-employed client with a $4 million net worth and he and his wife still couldn’t qualify for a HELOC or other type of second mortgage.

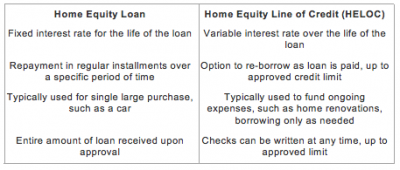

Why shouldn’t I just get a home equity loan?

As mentioned earlier, HELOCs and home equity loans are types of “second mortgages” secured by the equity you have built up in your primary residence. Generally, the choice between the two types of credit depends on your intended use for the money and your time frame for repayment. For instance, if you have a set amount in mind for a specific expense such as a wedding, a new septic system or new roof--and you have no further foreseeable expenses--then a fixed rate home equity loan makes sense. However, if your needs are more open-ended—say, a major home renovation that will span a year or two, or to supplement a child's college tuition each year for the next four years--then the more flexible HELOC could be the better option.

Unlike a convention loan with a fixed payment schedule, a HELOC allows you to pay down as much of the outstanding principal as you want when your cash flow is good, but only requires you to pay the minimum amount of interest when and no principal when cash is tight. Further, you can pay down the entire outstanding balance (draw) at any time during the duration of the loan term (typically 5-10 years)—and later tap into your line again as life circumstances change.

I’m sure those of you who are business owners understand this concept well.

Why should I pay “all that interest”?

That’s a refrain I often hear from clients and prospects. For example, say you have $300,000 in a taxable account, and you are debating whether to use $60,000 of this money for a major house remodel or get a HELOC. If you use the money from the taxable account, you could potentially have capital gains. If you get a HELOC, you could pay off that expense gradually and keep a lot more of your money fully invested—while deducting the HELOC interest from their taxable income if you can itemize. The typical answer for not choosing a HELOC is because most people don’t want to be paying “all that interest.”

We take a different approach when looking at interest. First, we look to see if you can write the interest off. Then we look at the average rate of return on your portfolio. If your portfolio has been averaging the same or more than the after-tax cost of the loan, then we recommend you go with the loan.

EXAMPLE: Let’s take a $60,000 loan at a 5 percent interest rate. If you can earn a 7-percent return on your portfolio, that 2-percent spread in your favor translates into $1,200 more in your pocket every year that you have the loan.

I know what you’re thinking: “I thought the interest on HELOCs isn’t deductible anymore (post Tax Reform).” Actually, it is as long as the funds are being used for home improvements.

(See Example 1 below).

Conclusion

If you or someone close to you has concerns about their cash flow and expense management needs, please don’t hesitate to contact me. I’d be happy to help.

Robert J. Pyle, CFP®, CFA is president of Diversified Asset Management, Inc. (DAMI). DAMI is licensed as an investment adviser with the State of Colorado Division of Securities, and its investment advisory representatives are licensed by the State of Colorado. DAMI will only transact business in other states to the extent DAMI has made the requisite notice filings or obtained the necessary licensing in such state. No follow up or individualized responses to persons in other jurisdictions that involve either rendering or attempting to render personalized investment advice for compensation will be made absent compliance with applicable legal requirements, or an applicable exemption or exclusion. It does not constitute investment or tax advice. To contact Robert, call 303-440-2906 or e-mail info@diversifiedassetmanagement.com.

The views, opinion, information and content provided here are solely those of the respective authors, and may not represent the views or opinions of Diversified Asset Management, Inc. The selection of any posts or articles should not be regarded as an explicit or implicit endorsement or recommendation of any such posts or articles, or services provided or referenced and statements made by the authors of such posts or articles. Diversified Asset Management, Inc. cannot guarantee the accuracy or currency of any such third party information or content, and does not undertake to verify or update such information or content. Any such information or other content should not be construed as investment, legal, accounting or tax advice.