Exit Planning for Business Owners

You’ve poured your blood, sweat, tears (and personal savings) into building a successful business. Congrats! You are considered a leader in your community, and you enjoy a sense of personal achievement that no corporate, government or non-profit employee could ever have. But there comes a time when taking some chips off the table—if not all of them—starts to sound appealing.

Most folks imagine you are quite wealthy by now but are you? Sure, you skimped on salary in the early years and didn’t put as much into your retirement account as you could have. But that shortfall will come back to you in spades after you sell, right?

With a median sale price of $225,000 for business, one can infer that only a small fraction of small business owners can cash out with enough money, so they never have to work again.

In fact, more than one-third of business owners (34%) have no retirement savings plan according to Manta, an online resource for small businesses owners. According to Manta data, many owners don’t feel they make enough money from their business to save for retirement. Others feel the need to tap all their savings to keep funding the business and don’t have enough left over to put toward retirement. More concerning, almost one in five owners told Manta they plan on using the expected proceeds from selling their business to retire on.

Supercharge your retirement savings especially if you’re in your 40s, 50s or 60s.

At a minimum, you should set up a 401(k) plan. If the plan is a “safe harbor” plan, then you should be able to contribute the maximum $19,000 a year to your 401(k)--$25,000 per year if you’re over age 50. (A Safe Harbor 401k plan allows employers to provide a plan to its employees and avoid the annual testing to make sure the plan passes nondiscrimination rules. In this type of plan, employers contribute a minimum required amount to the employees to avoid testing. A non-safe harbor plan involves expensive annual compliance testing.)

Typically, if you make an additional profit-sharing contribution to employees, you should be able to max out at $56,000 a year, or $62,000 if over age 50. If this is still not enough to put you on track for your retirement goals, you can start a cash balance plan and contribute up to $200,000 a year or more to your retirement savings, but this requires an even larger employee contribution. See my article about Cash Balance Plans.

The exit planning process starts 3-5 years out

Rare is the owner who receives a buyout offer out of the blue that’s simply too generous to pass up.

You don’t just wake up one day and decide to sell. You don’t just pace a “for sale” sign on the door outside your offices and expect buyers to line up. It’s going to take some planning and spit and polishing beforehand….just like selling a house or a car. Research shows most owners don’t come close to getting an offer that’s commensurate with what they think the value of their business is. In fact, surveys indicate that one of the biggest deal breakers for prospective buyers of a business is the sloppy record keeping of the owner. It is critical to keep great financial records, so the buyer knows what they are purchasing. In addition, you should have audited financial records.

An AES Nation survey of 107 corporate attorneys three fourth (77%) of them said failing to prepare companies financially was a common or very common problem for business owners. AES Nation says that the three most important ways owners can prepare for a sale are:

1. Improving the balance sheet. This means being more effective with cash management and receivables and getting rid of non-performing assets.

2. Addressing the cost of funds. This means getting the right loan covenants and maximizing working capital.

3. Getting audited financial statements. This reduces the likelihood that you, the entrepreneur, will have liabilities after the sales closes.

I recently gave a presentation to a group of CPAs, and they told me one horror story after another about business owner clients who try to sell their businesses without telling their CPA beforehand. Even worse, the CPA doesn’t hear about the planned sale until the frantic owner calls with a last-minute question on the way to the closing. That is NOT the time to ask your CPA questions or to seek advice. You really need a professional team to strategize with before the sale. I’ll talk more about the kinds of specialists you need in a minute.

Preparing your business for sale—don’t wait until the last minute

In addition to getting your cash flow and financial statements in order, it’s very important to manage your human capital, too. Nearly three fourths (72%) of lawyers surveyed by AES Nation said it was very common for owners to forget to prepare their key personnel for the transition to new ownership. Your key employees are among the most valuable assets you can offer to new ownership. Make sure you have employment contracts in place that incentivize key personnel to stay with the company. You also need non-compete and non-solicitation agreements.

According, to Sheryl Brake, CPA/CGMA, CVA, CEPA of Encompass Transition Solutions, LLC, “The biggest mistake that business owners make when planning to sell their business is not beginning the process early enough. The ideal time to start the process is 3 to 5 years before they actually want to transition out of their business. Beginning the process early gives the owner ample time to educate themselves, identify their options, and prepare the business for sale so that they maximize the value of the business and exit the business on their terms and their timeline.”

Avoid seller’s remorse

According to AES Nation, approximately half of business owners are unhappy after the sale of the company. To maximize the value of your business, you must improve the balance sheet, address the cost of funds, enhance the profits and make yourself “operationally irrelevant.”

One of the best books on business operations is called The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael Gerber. This book walks you through the steps from starting a business, growing a business and running a mature business. Until you can take a three-week vacation from the business and still have the enterprise run smoothly without you, all you really have is a demanding job. You don’t have a great business.

Don’t give your windfall to Uncle Sam

Selling a business is not all about getting the best price. It’s about maximizing the amount of money you and your family pocket after the sale is completed and what you do with that wealth—including planning the next chapter in your life.

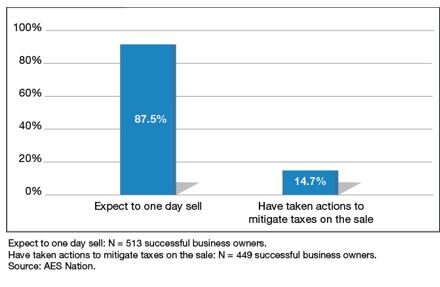

According to an AES Nation, about 85 percent of business owners have not taken steps to mitigate taxes before the sale of a company. One way to lower your tax hit after selling is to utilize a “freezing trust.” This is a trust that passes on the value of your business to your children or grandchildren free of estate tax. I can tell you more about this technique when we meet.

The general idea of a freezing trust is to gift some of your company stock to a trust and to sell more of the stock to the trust for a promissory note. When you gift the company stock to the trust and sell the company stock to the trust for a promissory note, you are getting the assets and future appreciation out of your taxable estate. When you sell the company, the value of the shares in the trust escapes estate taxes.

Your life v2.0

One of the hardest parts of retirement is deciding how to spend your time in your post-working retire. It’s even harder for successful business owners whose personal identify, values and reason for getting up in the morning is so intertwined with the business. Again, this process must start three to five years (not months) before you plan to sell. Some owners retire completely. Others stay on with the business in an advisory capacity. Others go back to work in another position—some even start a brand-new venture.

Don’t be a DIY when it comes to your exit

While it’s hard for many entrepreneurs to think they can’t sell their own business—who else knows it better? —countless studies show this is not a good idea. Selling a business successfully requires special skill sets that even your CPA and attorney often won’t have, let alone you.

You need a strong team including a CPA with experience in business transactions and possibly an investment banker. According to an AES Nation survey of corporate attorneys, nearly 92 percent strongly recommend using an investment banker if your business is valued between $1 and $10 million and almost all surveyed attorneys recommend using an investment bank if your business was valued at over $10 million. In fact, nearly half of surveyed attorneys (41.1%) recommended using an investment banker even if your business is valued at less than $1 million.

Conclusion

If you or someone close to you is considering selling their business, please don’t hesitate to contact me. I’d be happy to help.

Robert J. Pyle, CFP®, CFA is president of Diversified Asset Management, Inc. (DAMI). DAMI is licensed as an investment adviser with the State of Colorado Division of Securities, and its investment advisory representatives are licensed by the State of Colorado. DAMI will only transact business in other states to the extent DAMI has made the requisite notice filings or obtained the necessary licensing in such state. No follow up or individualized responses to persons in other jurisdictions that involve either rendering or attempting to render personalized investment advice for compensation will be made absent compliance with applicable legal requirements, or an applicable exemption or exclusion. It does not constitute investment or tax advice. To contact Robert, call 303-440-2906 or e-mail info@diversifiedassetmanagement.com.

The views, opinion, information and content provided here are solely those of the respective authors, and may not represent the views or opinions of Diversified Asset Management, Inc. The selection of any posts or articles should not be regarded as an explicit or implicit endorsement or recommendation of any such posts or articles, or services provided or referenced and statements made by the authors of such posts or articles. Diversified Asset Management, Inc. cannot guarantee the accuracy or currency of any such third party information or content, and does not undertake to verify or update such information or content. Any such information or other content should not be construed as investment, legal, accounting or tax advice.